From RM100001 to RM500000 2. From RM100001 to RM500000.

Cost Of Buying House In Malaysia

First RM 100000 - 1.

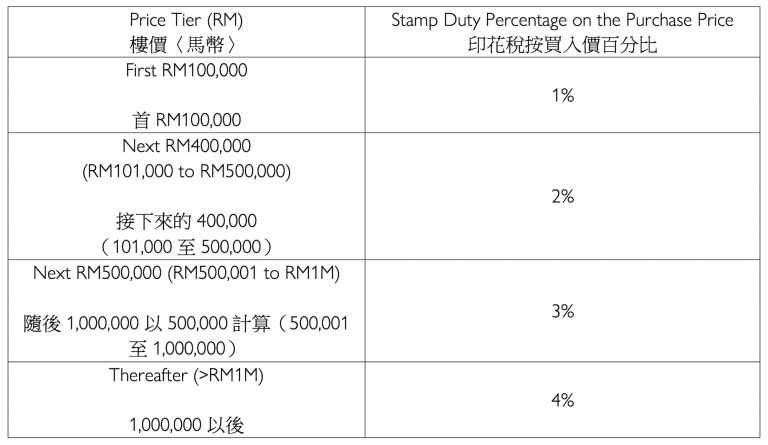

. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. Scroll down to check out the detailed tiers. The tax includes stamp duty on the Sale and Purchase Agreements SPA of your property and stamp duty for the Memorandum of Transfer MOT both of which are calculated based on the purchase price.

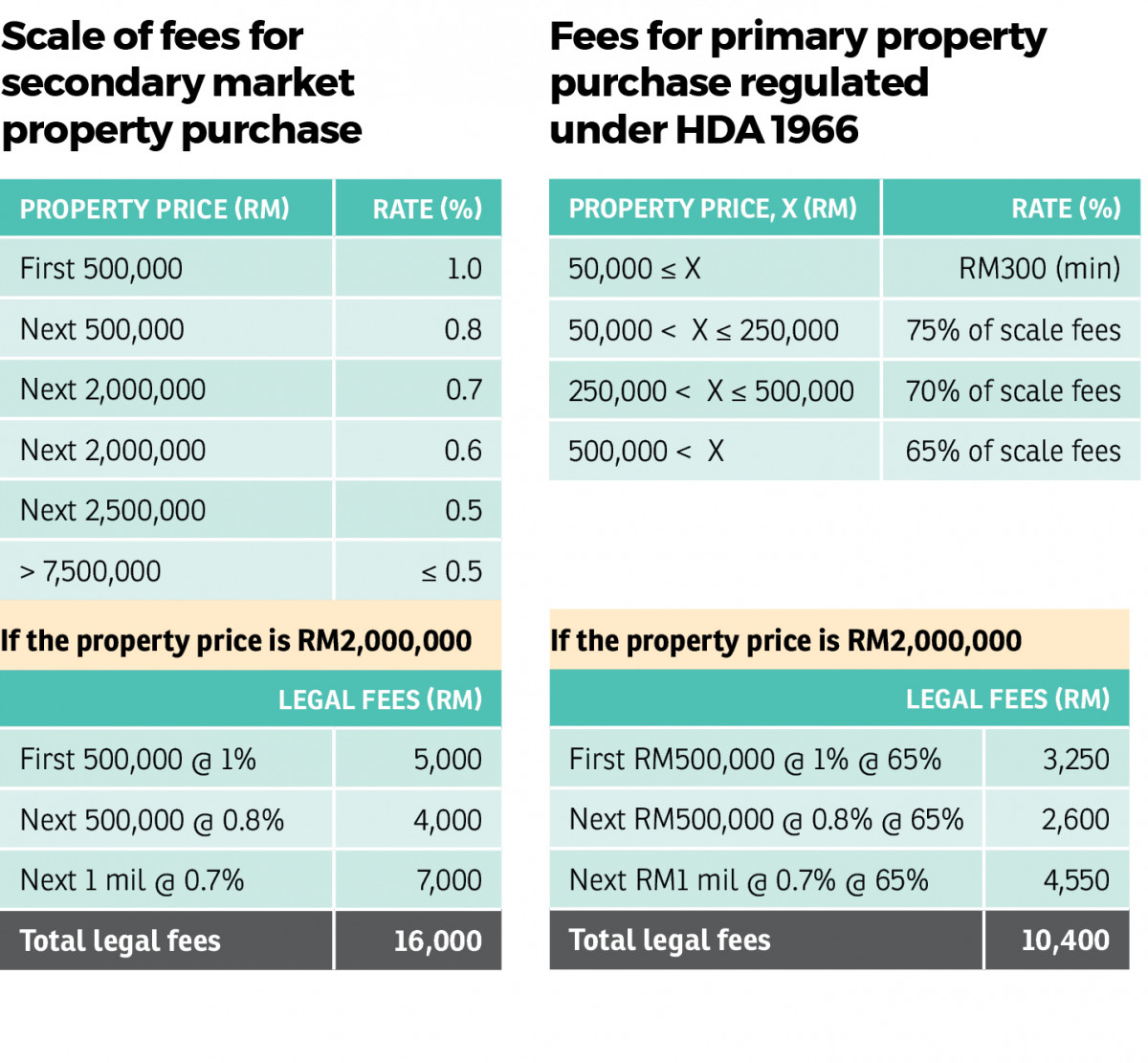

Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia. Sale and Purchase Agreement is not MOT. Sale Purchase Agreement SPA legal fees 1 for first RM500000 08 for the next RM500000 and 05 to 07 for subsequent amount.

You will also need to pay stamp duty on your loan agreement based on a flat rate of 05 of the total loan. The person liable to pay stamp duty is set out in. Both quotations will have slightly different in terms of calculation.

The Property Stamp Duty scale is as follows. The next 400000 RM101000 0. Total Stamp Duty Payable is RM24000.

You dont need a loan stamp duty calculator to calculate this. Memorandum of Transfer stamp duty. Next RM 500000 - 3.

RM400000 x 2 RM8000. Heres how to calculate your stamp duty. An unavoidable cost in real estate purchases stamp duty is the tax placed on your property documents during the sale or transfer of the property as specified under the First Schedule of Stamp Duty Act 1949.

MOT stamp duty is the stamp duty payable to effect the transfer of the property to you and is calculated in the ratio provided in the stamp act. The below exemption is applicable for sale and purchase agreement executed after 1 January 2021 but not later than 31 December 2025. When acquiring a property you can expect plenty of legal documents plus stamp duty tax on each document to top it off.

Memorandum of Transfer MOT is basically a transfer of ownership procedure of a real estate for the price agreed between the purchaser the vendor. At this point you will need to appoint a lawyer to act on your behalf to communicate with developers solicitor as well as to transact. The tax includes stamp duty on the Sale and Purchase Agreements SPA of your property and stamp duty for the Memorandum of Transfer MOT both of which are.

SPA Loan Agreement quotation includes Legal fees amount Disbursement Fees 6 SST and stamp duty. Stamp duty for the transfer of ownership title also known as a memorandum of transfer or MOT 1 for the first RM100000. Basically a Memorandum of Transfer MOT is the document a buyer signs when they are purchasing an item from a seller.

The property purchase price is RM1000000. This is the first form of tax imposed on any property buyer. Stamp duty is a tax based on specific tiers with its own percentage for each level.

For the first RM100000 1. Just use your physical calculator. RM500000 x 3 RM15000.

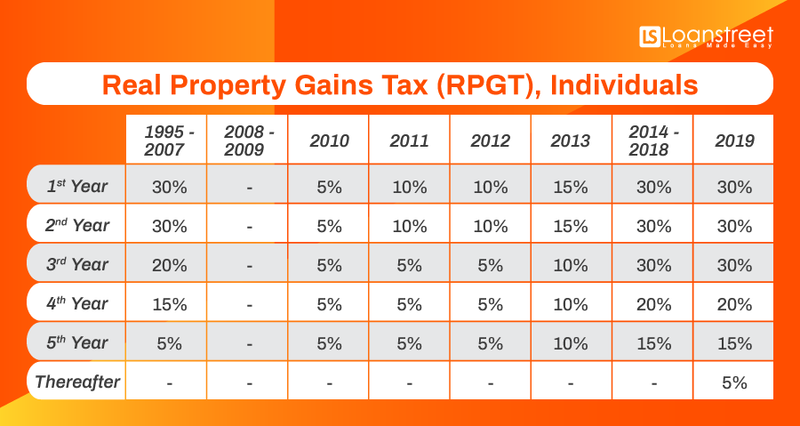

Who do you have to appoint to do perfection of transfer. Generally the higher the purchase price the higher the stamp duty. MOT and DOA stamp duty varies between 1 and 4 of the property sale price.

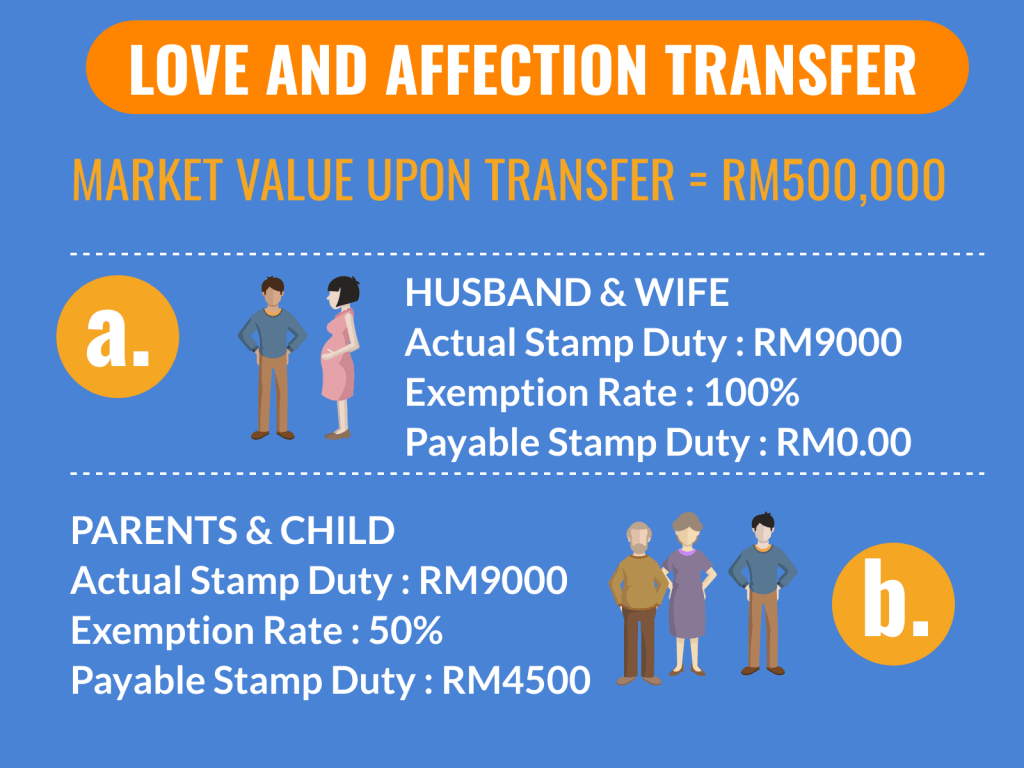

So lets look at the stamp duty fees. This consideration only applies when the transfer is from parent to children vice versa or from spouse to spouse. If the loan amount is RM500000 the stamp duty for the loan agreement is RM500000 x 050 RM2500.

RM100000 x 1 RM1000. The registering title into the purchasers name involves preparing the Memorandum of Transfer Form 14AMOT. Next RM 400000 - 2.

There is a consideration stated in the MoT for this particular type of transfer called love and affection. The Property Stamp Duty stands a considerable amount compare to other fees. From RM500001 to RM1million 3.

You will also need to pay the stamp duty on your loan agreement based on a flat rate of 05 of the total loan. The tiers are as follows with effect from 2019. For any MOT procedure a stamp duty is levied.

How Is Mot Stamp Duty Calculated. 2 on the next RM400000 and 3 on the subsequent amount. The cost of a memorandum of transfer or property transfer is consists of the professional legal fee stamp duty disbursement fees and sale and service tax.

Calculate now and get free quotation. Stamp Duty Malaysia On Instrument of Transfer. First RM100000 of the property price.

The MOT and DOA is no different and in fact is one of the heftiest when it comes to stamp duty costs. The MoT must still be adjudicated and stamped in these cases. Stamp dutyThis includes stamp duty on the Sale and Purchase Agreements SPA of your property and stamp duty for the Memorandum of Transfer MOT which are calculated based on the purchase price.

Property Transfer Stamp Duty. The exemption applies for a maximum loan amount of RM500000. The loan agreement Stamp Duty is 050 from the loan amount.

1 Mil - 4. Stamp duty for Memorandum of transfer in Malaysia MOT Malaysia can be extremely pricey and do check out the chart below for the tier rate. In an effort to reduce the cost of ownership of first home for Malaysian citizens the government has proposed the following stamp duty exemptions-.

This can be also referred to as a property stamp duty. Stamp duties are imposed on instruments and not transactions. Specifically parents to children or spouses.

How To Transfer Property Ownership Between Family Members In Malaysia Propsocial

Stamp Duty Legal Fees New Property Board

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Imperio Group Memorandum Of Transfer Mot Also Known As Stamp Duty Is Used To Transfer The Ownership Of Property To You Buyer Check Out How The Fee Works In The Chart

What Is A Trust Deed And Why Is It Important

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Mot Calculation 2020 Property Paris Star

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Cost Of Buying House In Malaysia

Mot And Stamp Duty In Malaysia Maxland Real Estate Agency

What Is Memorandum Of Transfer How Does It Work In Malaysia Blog

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

What Expenses Are There When Purchasing Malaysia Property Here Is A Full Checklist Indicating The Total Expenses

Upfront Costs Of Purchasing A Home In Malaysia Propsocial

Count The Cost Of Buying A Property

What Is Memorandum Of Transfer How Does It Work In Malaysia Blog

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan